Interest rates have risen over 1.5% over three months, and prices are continuing to rise. This quarter the apartment market has set record highs in rent growth, demand and occupancy, toppling multi decade long peaks set just last quarter.

The appetite for housing is continuing to power unprecedented levels and conditions, investors in Atlanta are buying over a third of homes listed on the market, with Wall Street hedgefunds and foreign investors making up a large percentage of the share. Being one of the top magnet markets in Atlanta, secondary home purchases have gone way up as well.

Due to the pandemic and inflation among other factors, the wealth gap is continuing to grow. I’m still seeing prices rise, as comps that have closed set the new listings, but not as aggressively as they had been in the last year. One thing I am paying attention to and hopefully can bring more inventory, particularly in Atlanta, is the aging population downsizing or moving to retirement communities, which is seeming to pick up.

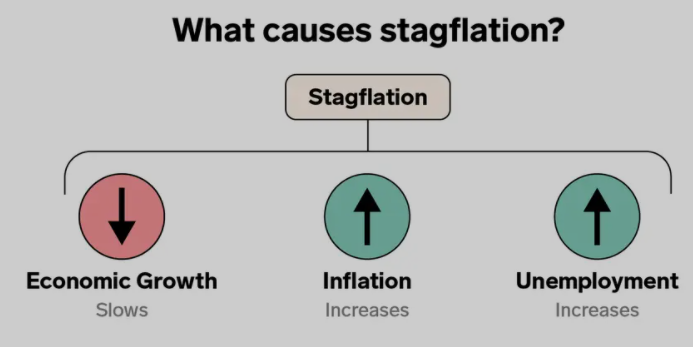

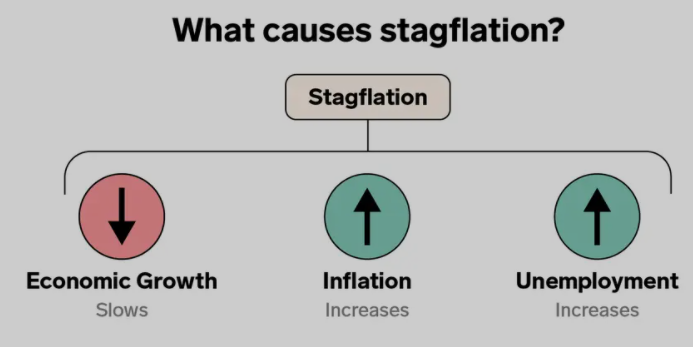

What I’m most concerned about is stagflation and how it will affect real estate, (stagflation is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high). As the recurring story, I don’t see the hunger for real estate suppressing anytime soon.